J. Mark Lowe, CG, FUGA

Discover the variety of North Carolina tax records, and how they can tell you more than the amount due. Learn where they are located, and when to look at alternate sources for information.

Taxation in the Americas began within the colonies for the crown. By the time, the constitution was written in 1787, all colonies were taxing citizens on property, capitation (head), livestock, and other properties. The constitution gave specific authority to the state to levy and collect taxes. For purposes of our discussion, we will focus on the levy on people (poll tax), property and other personalty.

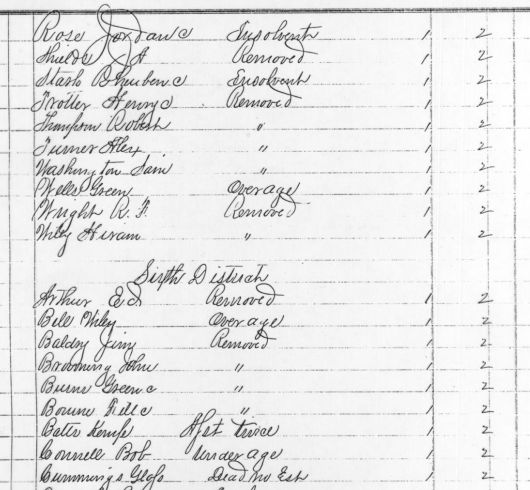

(Image source: “Tax Release List,” courtesy J. Mark Lowe, © 2014)

Taxation in the Americas began within the colonies for the crown. By the time, the constitution was written in 1787, all colonies were taxing citizens on property, capitation (head), livestock, and other properties. The constitution gave specific authority to the state to levy and collect taxes. For purposes of our discussion, we will focus on the levy on people (poll tax), property and other personalty.

The North Carolina General Assembly in 1715 defined taxable persons as free Males over sixteen years of age. Basically a tax list is a register of free males, land owners, and slave owners who, by nature of their age or ownership, are required to pay taxes to the governmental authority. But there is so much more to learn.

Available in the NCGS online bookstore is North Carolina Research – Genealogy and Local History, the text for the NCGS Webinar Series. For more information about the speaker, please see our flyer (pdf file).

You must be signed in to your NCGS membership account to view this resource.