J. Mark Lowe, CG, FUGA

Discover the variety of North Carolina tax records, and how they can tell you more than the amount due. Learn where they are located, and when to look at alternate sources for information.

Taxation in the Americas began within the colonies for the crown. By the time, the constitution was written in 1787, all colonies were taxing citizens on property, capitation (head), livestock, and other properties. The constitution gave specific authority to the state to levy and collect taxes. For purposes of our discussion, we will focus on the levy on people (poll tax), property and other personalty.

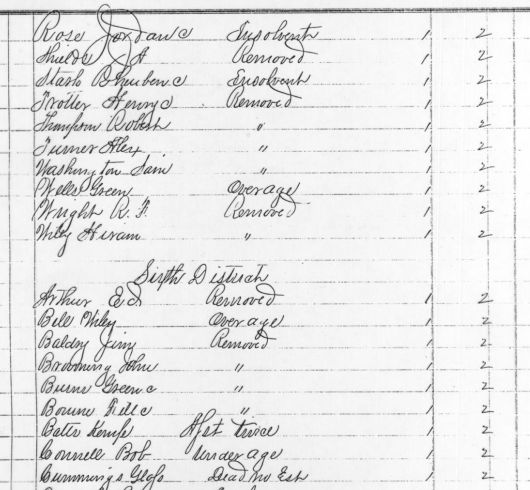

The North Carolina General Assembly in 1715 defined taxable persons as free Males over sixteen years of age. Basically a tax list is a register of free males, land owners, and slave owners who, by nature of their age or ownership, are required to pay taxes to the governmental authority. But there is so much more to learn.

(Image source: “Tax Release List,” courtesy J. Mark Lowe, © 2014)

Available in the NCGS online store is North Carolina Research – Genealogy and Local History, the text for the NCGS Webinar Series.

The handout will only be visibly accessible to the public during the specified play dates.

NCGS Members may access all handouts any time from the main Webinars page (under the Education & Events menu). (Each video page in the Member Webinars area also has a direct link to the appropriate handout.)

The video player will not be visible except during specified play dates. If not visible during that time, refresh your browser.